How do initial coin offerings (ICOs) differ from traditional IPOs (Initial Public Offerings)?

Are you curious about the exciting world of fundraising in the digital age? Initial Coin Offerings (ICOs) and Traditional IPOs offer unique opportunities for investors and companies alike. Join us on a journey to explore how these two fundraising methods differ, from their investment processes to legal implications, and discover which option may be right for you. Let’s dive in!

What are Initial Coin Offerings (ICOs)?

Initial Coin Offerings (ICOs) are a relatively new way for companies to raise capital by issuing digital tokens or coins to investors. These tokens represent an investment in the project and can often be traded on cryptocurrency exchanges. ICOs typically take place on blockchain platforms, allowing for decentralized fundraising without the need for intermediaries.

Investors who participate in ICOs purchase these tokens using cryptocurrencies like Bitcoin or Ethereum. The allure of potentially high returns drives many individuals to invest in ICO projects, hoping to get in early on the next big thing in the crypto world.

One key aspect of ICOs is that they offer greater accessibility compared to traditional IPOs, as anyone with an internet connection and cryptocurrency can participate. This democratization of investing has attracted a wide range of participants, from seasoned investors to newcomers looking to dip their toes into the world of digital assets.

What are Traditional IPOs?

Traditional Initial Public Offerings (IPOs) are a common way for companies to raise capital by offering shares of their stock to the public for the first time. This process involves a company working with investment banks to underwrite and sell its shares on a stock exchange like NYSE or NASDAQ.

In traditional IPOs, companies go through a rigorous regulatory process overseen by government agencies like the SEC to ensure transparency and protect investors. The company’s financial information is disclosed in a prospectus, allowing potential investors to make informed decisions before buying shares.

Investors who participate in traditional IPOs typically include institutional investors, such as mutual funds and pension funds, as well as individual retail investors looking to invest in established companies poised for growth.

Once the IPO is completed, the company becomes publicly traded, meaning its shares can be bought and sold on the open market, providing liquidity for both existing shareholders and new investors alike.

Differences in the Investment Process

When it comes to the investment process, Initial Coin Offerings (ICOs) and Traditional Initial Public Offerings (IPOs) have distinct differences. In ICOs, investors typically purchase digital tokens using cryptocurrencies or fiat currency. These tokens represent a stake in a project or company but do not offer ownership rights.

Conversely, in IPOs, investors buy shares of a company, giving them ownership stakes and voting rights. The process involves underwriters who help price and sell the shares to the public through stock exchanges like NYSE or NASDAQ.

ICOs tend to have lower barriers to entry for both companies seeking funding and individual investors. This accessibility has attracted a wide range of participants globally. On the other hand, IPOs are more regulated with strict requirements set by financial authorities.

Despite these differences, both ICOs and IPOs provide opportunities for investors to support innovative projects while potentially earning returns on their investments. Each method offers unique advantages and challenges that appeal to different types of investors based on their risk tolerance and investment goals.

Regulation and Legal Issues

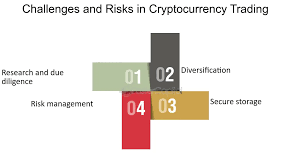

Navigating the regulatory landscape is a crucial aspect when comparing Initial Coin Offerings (ICOs) and Traditional IPOs. ICOs operate in a relatively unregulated environment, allowing for flexibility but also posing risks due to potential lack of investor protection. On the other hand, IPOs are subject to strict regulations set by governing bodies like the SEC, ensuring transparency and accountability.

Legal issues surrounding ICOs often revolve around concerns such as fraud, security breaches, and money laundering due to their decentralized nature. Conversely, IPOs have established legal frameworks that companies must adhere to before going public.

Regulatory bodies are increasingly scrutinizing ICOs to protect investors from scams and ensure compliance with existing laws. In contrast, traditional IPOs follow a standardized process overseen by regulatory authorities to safeguard investor interests.

Understanding the distinct regulatory and legal considerations between ICOs and IPOs is essential for both investors and companies entering the fundraising market.

Advantages and Disadvantages of ICOs and IPOs

When it comes to Initial Coin Offerings (ICOs) and Traditional IPOs, each option has its own set of advantages and disadvantages.

One advantage of ICOs is that they offer a quicker and more accessible way for companies to raise capital compared to traditional IPOs. This can be appealing for startups or small businesses looking to fund their projects.

On the other hand, one disadvantage of ICOs is the lack of regulations and potential for fraudulent activities in the market. Investors need to be cautious due to the high risk involved in investing in ICOs.

In contrast, Traditional IPOs are regulated by governmental bodies, providing investors with a sense of security and transparency. Companies going public through an IPO also gain credibility and exposure in the financial markets.

However, one downside of Traditional IPOs is the lengthy process involved, which can be time-consuming and expensive for companies seeking funding.

Impact on Investors and Companies

Investors are drawn to ICOs for their potential high returns, but the volatility and lack of regulation can pose risks. Companies launching ICOs may benefit from quick access to funding without giving up equity, but they must navigate the complexities of creating a token economy.

On the other hand, traditional IPOs offer investors more regulatory protection and transparency. However, companies going public through an IPO incur higher costs and face stricter compliance requirements.

Investors in IPOs have the opportunity to invest in well-established companies with proven track records. These offerings often attract institutional investors looking for stability and long-term growth prospects.

In contrast, ICO investors tend to be more speculative, hoping to get in on the ground floor of a potentially revolutionary project. The success or failure of an ICO can significantly impact both investors’ portfolios and the future trajectory of a company.

Conclusion

Initial Coin Offerings (ICOs) and Traditional IPOs have distinct differences in their investment processes, regulation, advantages, and disadvantages. ICOs provide a new way for companies to raise funds through cryptocurrency offerings, while IPOs offer shares to the public on traditional stock exchanges. Both methods have their own set of pros and cons that investors and companies need to consider carefully before choosing the right path for fundraising. As the financial landscape continues to evolve with blockchain technology and digital currencies, understanding these differences is crucial for making informed investment decisions in today’s ever-changing market environment.