What impact could central bank digital currencies (CBDCs) have on the adoption of cryptocurrencies?

Introduction to Central Bank Digital Currencies (CBDCs)

Step into the exciting world of digital currencies, where innovation and evolution collide! Central Bank Digital Currencies (CBDCs) are shaking up the financial landscape, potentially reshaping how we perceive and utilize cryptocurrencies. Join us on a journey to explore the impact that CBDCs could have on the adoption of these virtual assets. Strap in for a thrilling ride through the future of money!

The Current State of Cryptocurrencies

Cryptocurrencies have come a long way since the inception of Bitcoin in 2009. What started as an experimental digital currency has now evolved into a diverse ecosystem of thousands of cryptocurrencies, each with its own unique features and use cases.

Despite facing volatility and regulatory challenges, cryptocurrencies have gained widespread acceptance and adoption across various industries. From retail to finance, more businesses are exploring ways to incorporate digital currencies into their operations.

The rise of decentralized finance (DeFi) platforms has revolutionized traditional financial services by offering innovative solutions such as lending, borrowing, and trading without the need for intermediaries.

As blockchain technology continues to mature, new projects are constantly being developed to address scalability issues and enhance security measures within the crypto space. With growing interest from institutional investors and mainstream adoption on the horizon, the future looks promising for cryptocurrencies.

Potential Impact of CBDCs on Cryptocurrency Adoption

With the rise of Central Bank Digital Currencies (CBDCs), the landscape of cryptocurrencies is poised for a potential shift. CBDCs, being government-backed digital currencies, could bring about both challenges and opportunities for existing cryptocurrencies like Bitcoin and Ethereum.

One potential impact of CBDCs on cryptocurrency adoption is increased legitimacy and acceptance by mainstream financial institutions. As governments embrace digital currencies, it may pave the way for greater regulatory clarity in the crypto space, attracting more traditional investors.

On the other hand, some crypto enthusiasts fear that CBDCs could pose a threat to decentralization – a core principle of many cryptocurrencies. The centralized nature of CBDCs could potentially undermine the appeal of decentralized cryptocurrencies among users who value privacy and autonomy.

While CBDCs have the potential to influence cryptocurrency adoption significantly, only time will tell how these two forms of digital currency will coexist in the ever-evolving financial ecosystem.

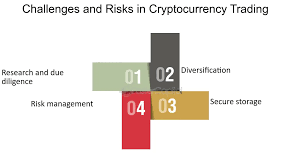

Advantages and Disadvantages of CBDCs for Cryptocurrencies

Central Bank Digital Currencies (CBDCs) have the potential to revolutionize the way we transact in the digital age. One advantage is that CBDCs could provide a sense of legitimacy and stability to the cryptocurrency market, attracting more institutional investors and mainstream adoption.

On the flip side, some argue that CBDCs might pose a threat to decentralized cryptocurrencies by centralizing control back in the hands of governments and traditional financial institutions. This could potentially undermine one of the key principles behind cryptocurrencies – decentralization.

Additionally, while CBDCs may offer increased efficiency and lower transaction costs compared to traditional banking systems, they could also raise concerns about privacy and surveillance. With every transaction being recorded by a central authority, individual privacy rights may be at risk.

Despite these drawbacks, it’s important to consider how CBDCs can complement existing cryptocurrencies rather than viewing them as direct competitors. Finding a balance between innovation and regulation will be crucial in shaping the future relationship between CBDCs and cryptocurrencies.