What are stablecoins and how do they differ from other cryptocurrencies like Bitcoin?

Introduction to Cryptocurrencies

Step into the exciting world of cryptocurrencies, where digital assets are revolutionizing the way we think about money. Among the myriad options available to investors and enthusiasts alike, stablecoins have emerged as a unique and increasingly popular choice. But what sets stablecoins apart from traditional cryptocurrencies like Bitcoin? Let’s dive in to uncover the differences and explore the fascinating realm of stablecoins.

What are Stablecoins?

Cryptocurrencies have revolutionized the way we perceive and utilize digital assets. Among the various types of cryptocurrencies available in the market, stablecoins stand out for their unique characteristics. But what exactly are stablecoins?

Stablecoins are a type of cryptocurrency that is designed to minimize price volatility by pegging their value to a stable asset, such as fiat currency like USD or commodities like gold. This pegging mechanism helps stabilize the price fluctuations often associated with traditional cryptocurrencies like Bitcoin.

Unlike other cryptocurrencies that experience significant price changes, stablecoins aim to maintain a steady value over time. This stability makes them attractive for users looking to transact or store value without being exposed to extreme market volatility.

Stablecoins offer an intriguing alternative within the cryptocurrency landscape, providing a more predictable and reliable option for users seeking stability in their digital transactions.

The Difference Between Stablecoins and Other Cryptocurrencies

When it comes to cryptocurrencies, one key distinction lies in the stability factor. While traditional cryptocurrencies like Bitcoin can have volatile price fluctuations, stablecoins are designed to maintain a stable value.

Stablecoins achieve this stability by pegging their value to another asset like fiat currency or commodities. This pegging mechanism helps ensure that the price of stablecoins remains relatively constant compared to other cryptocurrencies.

Moreover, stablecoins provide users with a reliable medium of exchange and store of value due to their steady pricing. This feature makes them more suitable for everyday transactions and financial activities where price volatility is not desirable.

In contrast, traditional cryptocurrencies like Bitcoin rely on market demand and supply dynamics to determine their price, leading to significant fluctuations that can impact usability in day-to-day transactions.

Understanding the difference between stablecoins and other cryptocurrencies is essential for investors and users looking for stability within the volatile world of digital assets.

Advantages of Stablecoins

Stablecoins offer a range of advantages that set them apart from other cryptocurrencies like Bitcoin. One key advantage is their stability, as the name suggests. This stability is achieved by pegging the value of stablecoins to fiat currencies or other tangible assets, providing users with a more predictable store of value.

Another advantage of stablecoins is their ability to facilitate faster and cheaper transactions compared to traditional banking systems. With stablecoins, users can transfer funds across borders quickly and at lower fees than traditional methods.

Moreover, stablecoins offer increased privacy and security due to their decentralized nature. Users can conduct transactions anonymously without relying on intermediaries such as banks or financial institutions.

Additionally, stablecoins provide a hedge against market volatility since they do not experience the extreme price fluctuations seen in other cryptocurrencies. This makes them an attractive option for investors looking for more stability in their digital assets portfolio.

Common Types of Stablecoins

When it comes to stablecoins, there are several common types that serve different purposes in the cryptocurrency market.

One type is fiat-collateralized stablecoins, which are backed by traditional assets like US dollars held in reserves. These stablecoins aim to maintain a 1:1 ratio with the fiat currency they are pegged to.

Another type is crypto-collateralized stablecoins, which are backed by other cryptocurrencies instead of fiat currencies. This method involves overcollateralization to ensure stability and mitigate risks.

Algorithmic stablecoins rely on smart contracts and algorithms to regulate the coin’s supply based on demand, aiming for price stability without physical collateral.

We have commodity-backed stablecoins tied to physical assets like gold or silver. These provide a level of security and value preservation beyond traditional fiat currencies.

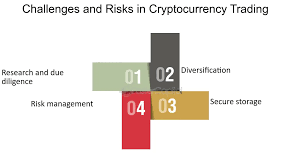

Challenges and Controversies Surrounding Stablecoins

Navigating the world of stablecoins comes with its fair share of challenges and controversies. One major issue is regulatory uncertainty, as governments grapple with how to classify and regulate these digital assets. The lack of a clear legal framework can create instability in the market, making investors wary.

Another concern revolves around the centralization of some stablecoins. Critics argue that this goes against the decentralized ethos of cryptocurrencies like Bitcoin. Centralized control over stablecoin issuance and reserves could potentially lead to manipulation or censorship.

Security is also a hot topic when it comes to stablecoins. As digital assets, they are vulnerable to hacks and cyber attacks. Ensuring robust security measures is crucial for maintaining trust among users and investors.

Moreover, questions about transparency in stablecoin operations have been raised, with some projects being accused of lackluster reporting practices. This opacity can breed skepticism within the crypto community and beyond.

While stablecoins offer exciting possibilities for the future of finance, addressing these challenges will be key to their long-term success and acceptance in mainstream markets.

Conclusion: The Future of Stablecoins in the Cryptocurrency Market

As the cryptocurrency market continues to evolve and expand, stablecoins are expected to play a significant role in providing stability and reliability for users. With their ability to mitigate volatility and maintain a steady value, stablecoins offer a promising solution for those looking to transact in digital assets without the worry of price fluctuations.

While challenges and controversies persist around regulatory concerns, transparency issues, and centralization risks, the growing adoption of stablecoins indicates a positive outlook for their future. As more financial institutions, businesses, and individuals recognize the benefits of stablecoins, we can anticipate further innovation in this space with new types of stablecoins emerging to cater to different needs.

Stablecoins are poised to become an essential part of the cryptocurrency ecosystem, offering a bridge between traditional finance and decentralized digital assets. Their continued development and integration into various industries suggest that they will continue to thrive as a reliable alternative within the ever-changing landscape of cryptocurrencies.